Why it is so hard to disco a SKU

Sprouts (NASDAQ:SFM) vs S&P 500, ag funding, USDA spending, farmer co-op collabs... and more!

3-min read

It feels silly to put out this newsletter without some acknowledgment of the latest economic news. So let’s get that over with.

The economy is looking bad

After last week’s jobs report and a major sell-off in the markets, we are probably in a recession — history will tell us.

There’s a major downturn in the ag sector, with crop prices so depressed they won’t cover the cost of production let alone interest on debt. We are in a trade deficit, which is not normal, and just yesterday the USDA posted another $300M to support trade. There is a call for strengthening the farm bill — more government spending — which we know is not sustainable.

With all that bad news where is consumer confidence? Q2 was surprisingly good. Going forward the USDA expects lower food prices overall —

but importantly, now that eating has become “mindful”, people expect a lot more out of every dollar and every calorie, and will pay for that quality.

With that in mind, a history lesson: The almond butter brand I founded in 2006 scaled during the worst GDP and unemployment rate since the early 90’s (the period 2005 – 2012 is now called the Great Recession) and surprisingly, the brand survived – no, thrived – during that time.

For many of you it’s a matter of keeping your head down, sticking to first principles, and not panicking.

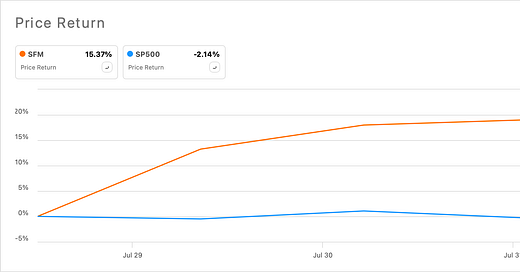

While the S&P 500 went in the toilet — look at Sprouts! (NASDAQ:SFM)

Sprouts posted excellent Q2 earnings, and analysts say Sprouts has great underlying demand trends with incredibly good store traffic (*this is not investment advice).

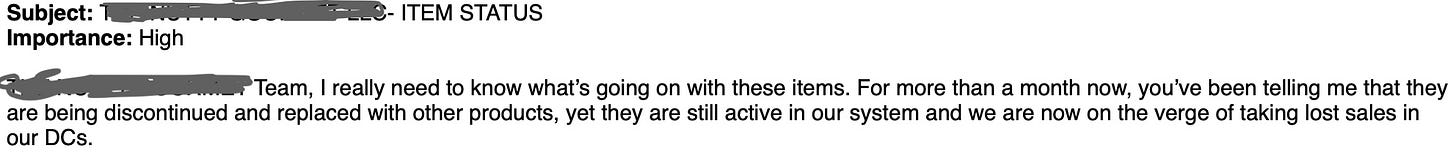

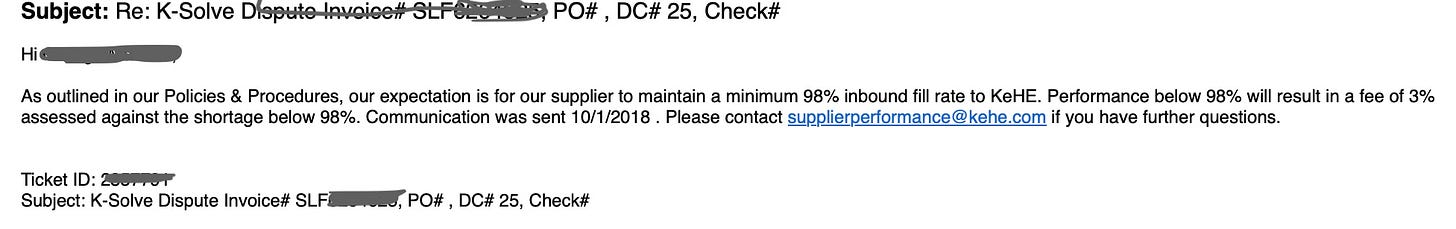

It’s so hard to discontinue SKUs

Let me tell you a little secret — distributor business is not good testing grounds for your products. When you want to switch out a SKU, it’s not just coordinating the disco — it’s getting out alive. The fees and chargebacks seem to have no end.

Do all your testing online or with direct store business. Your products should have strong sales with high repeat rates before going out into distribution.

Co-ops can do cool collabs too

Welch’s is owned by ~700 grape farmers.

This past week, $2.2B awarded to discriminated farmers

This, as part of the Inflation Reduction Act, which is supposed to help producers stay on the farm, prevent them from becoming ineligible for future assistance, and promote climate-smart agriculture by increasing access to conservation assistance.

No one is buying new farm equipment

Estimates of the total number of layoffs globally are well north of 1,000 at this point, though John Deere has never confirmed the exact number let go. - AgWeb

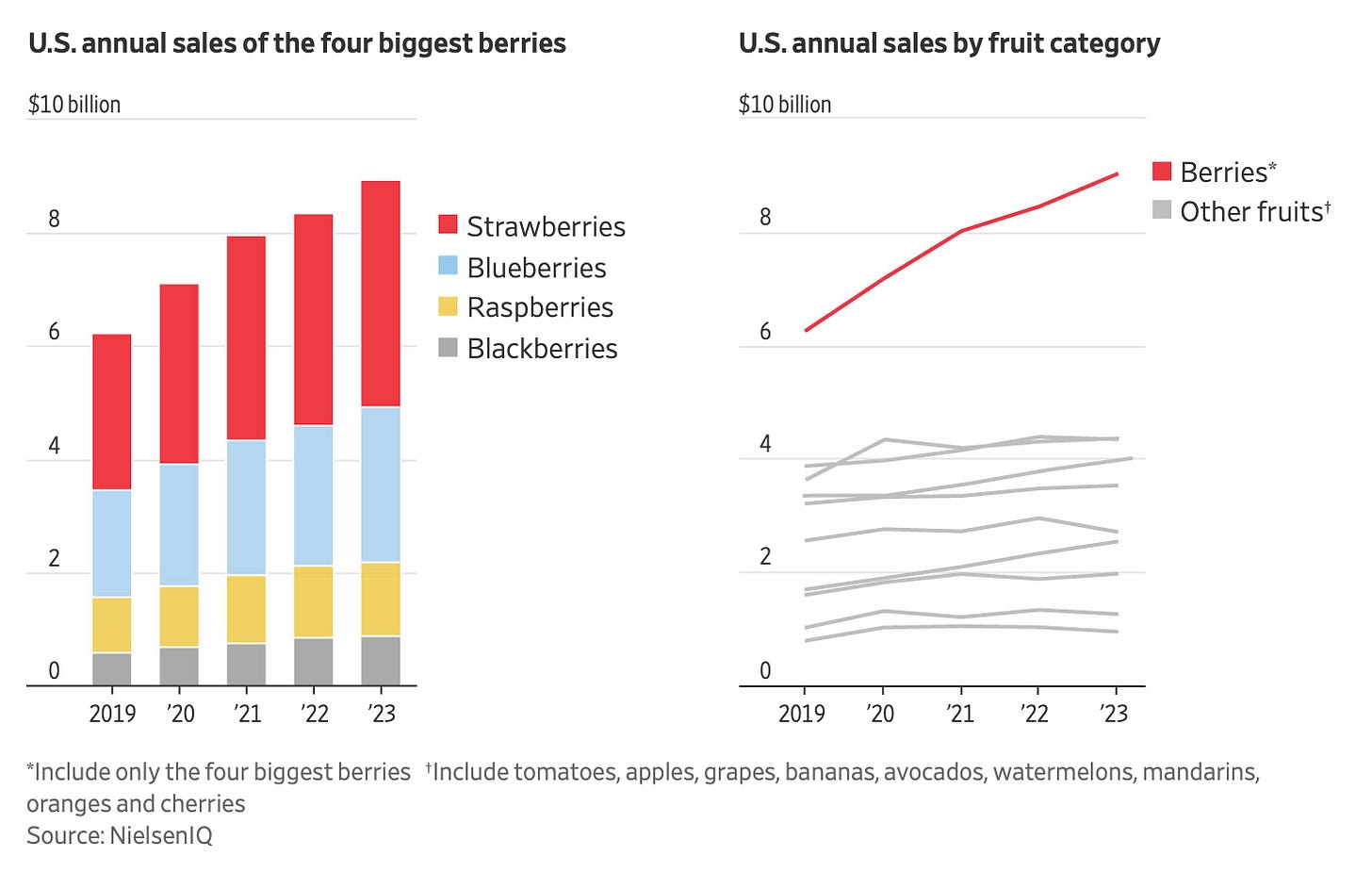

Berry producer Agrovision just closed $100m in funding

I told you berries are a big deal.

Who is going to Newtopia? LMK in the comments — I’ll be there!

All my best,

Jennifer