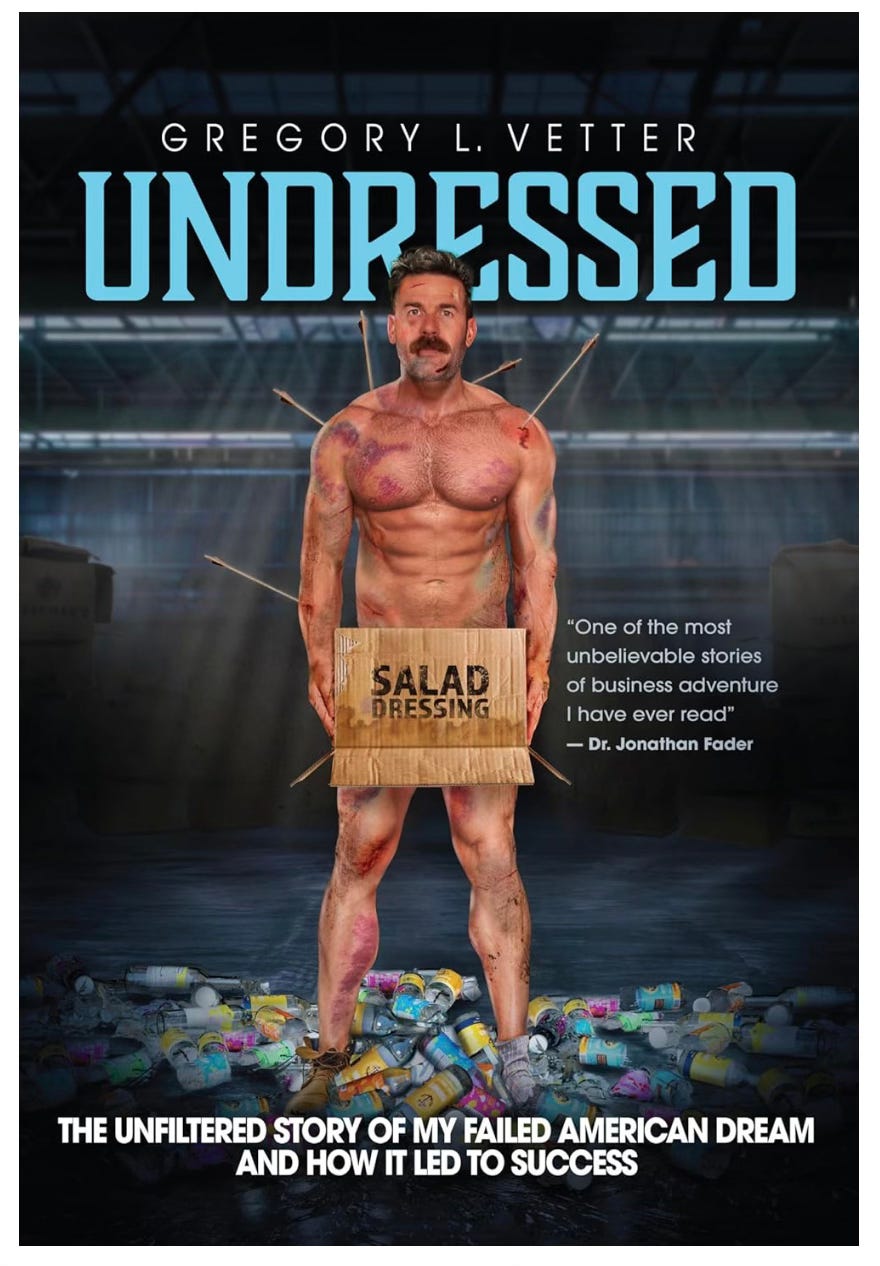

This week, cookie dough startup Doughp is searching for new operators, and a salad dressing founder who lost control of his eight-figure company writes a book about it to rave reviews (James Richardson’s description is, “classic, investor-fueled Board fight for control, ego satisfaction, and maximizing returns from someone else's hard work.”)

Doughp is in startups-die-when-entrepreneurs-give-up mode, as captured by this quote:

“It’s really hard to kill a good product, and we’ve seen that Doughp won’t die; it can’t die,” one of the founders said.

In any case, here is what I wish food founders knew:

Start earlier

The number one thing I wish most founders would do is come to the realization that it’s time to sell much sooner. This is because from start to finish, selling your business could take a year. During that year you have to still have an attractive asset. That means you need to keep shipping product.

Have something to sell

Unless you are a co-man, understand that what you are selling is loyal customers. Period. You are not selling a formula or a process or anything product related. You’re not even selling brand equity – because at your size you don’t have much brand equity – you are selling a consumer base that repeat buys at a consistent point of purchase. That means you have to demonstrate repeat sales at your points of distribution whether they are physical or digital.

Resist increasing distribution

Please don’t try to goose your numbers by getting into more stores. If you already know you can’t support the existing business, you are hurting yourself by getting more business. Do the opposite. Sounds crazy but focus on your core and get out of everything else. Choose the most capital efficient customers and do what you must to increase velocity. Get the movement reports and show that with proper attention and investment, your products do well.

Get help

Hiring an industry specific investment banker or broker is ideal, but if you’re revenues are under $5m, there is a dearth of brokers and investment bankers won’t even talk to you. Listing your business for sale on websites is useless. An advisor or mentor could act as an M&A consultant to help you. Your greatest asset here is your network. Leverage the people you know. One of the biggest trends in CPG is vertical integration, so someone along your supply chain or manufacturers seeking adjacencies are great targets. The best people who can connect you are the people closest to you.

other news

Linktree Stores social commerce marketplace is going to make it easier for small brands to have their own dedicated creator programs. Modern Retail

The judge handling a proposed class action lawsuit accusing Danone of misleading shoppers with ‘carbon neutral’ claims on Evian bottled water has reversed his earlier ruling and dismissed claims that a reasonable consumer would find the phrase deceptive. Ag Funder News

The story behind the Bonne Maman Advent Calendar is fun New York Times

Ayoh! has made leftovers something to look forward to — I love all the flavors

That’s all folks!

All my best,

Jennifer