I don’t know any founder in food and beverage that does not want a Siete or Poppi-like exit. But y’all know that is highly rare and unlikely, so what kind of exit is actually possible?

Also in this post:

🍝 Dry pasta gets sexy

🚜 Right to Repair gets funny

🫙 Do we need more Front-of-Pack labeling regulation?

“North American Semolina grains and artisanal bronze dies” — dry pasta is having a resurgence. Even low carb pasta is now *tasty* — Hero bread’s sold out in one day

I’ve been enjoying 3 Farm Daughter’s pasta made from a special high amylose variety wheat that provides more fiber. So it’s prebiotic pasta that looks and tastes high end.

Culinary brand Flour + Water, of the restaurant in San Francisco, is collaborating on a Ultimate Mac Salad Bundle (pictured) with Jacobsen Salt Co. — on sale this Friday.

Hero Bread is a zero net carb brand. The pasta launch follows the success of their bagel roll out, which took the spot at Whole Foods where Better Brand’s (queue Better Bagel scandal) left a hole (har har).

Why pasta? As Hero CEO YC Cheng put it,

“If you want the nutrition around fiber, protein, no sugar, lower carbohydrate then you are generally pushed towards something with an alternate protein or carbohydrate like chickpeas or quinoa or something like that.”

…which don’t taste very good— my words.

Egglife’s no boil pasta. This is just egg noodles, right? The no boil has me skeptical. Someone needs to tell me if it’s good —

Dry pasta, like many other categories, is being disrupted by taste and minimal ingredients with high functionality.

What do y’all think of Front-of-Pack labeling ?

I’m generally not in favor of more regulation on food packaging, because more boxes with numbers and call outs makes beautiful branding harder. And I don’t believe that American’s are unhealthy because they don’t know how to read a nutrition label.

But I must be wrong.

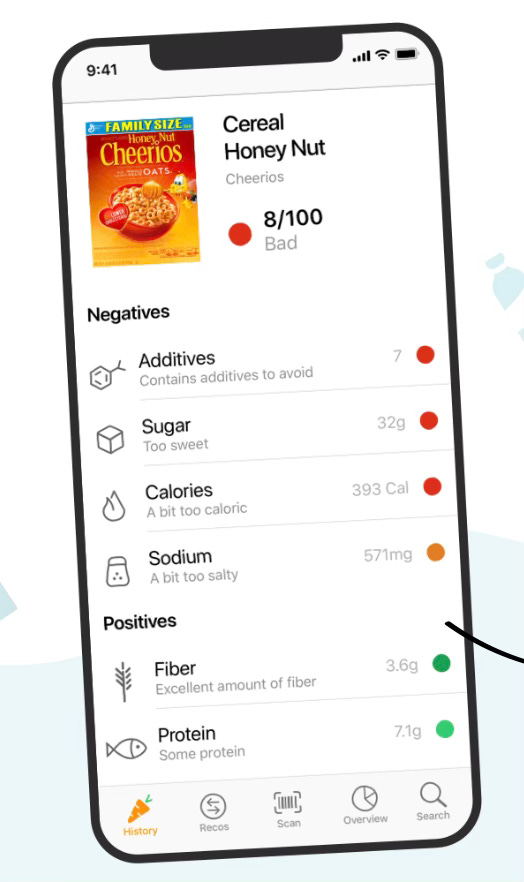

Yuka, the mobile food scanning app is more popular than ever, and a bunch of brands just launched the Good Food Collective which will be a first mover towards mandatory front-of-pack labeling ahead of the FDA (which has done nothing on this yet, btw).

The thing is, Yuka is a tool that empowers people vs the Good Food Collective is about visible warnings. Would love your thoughts.

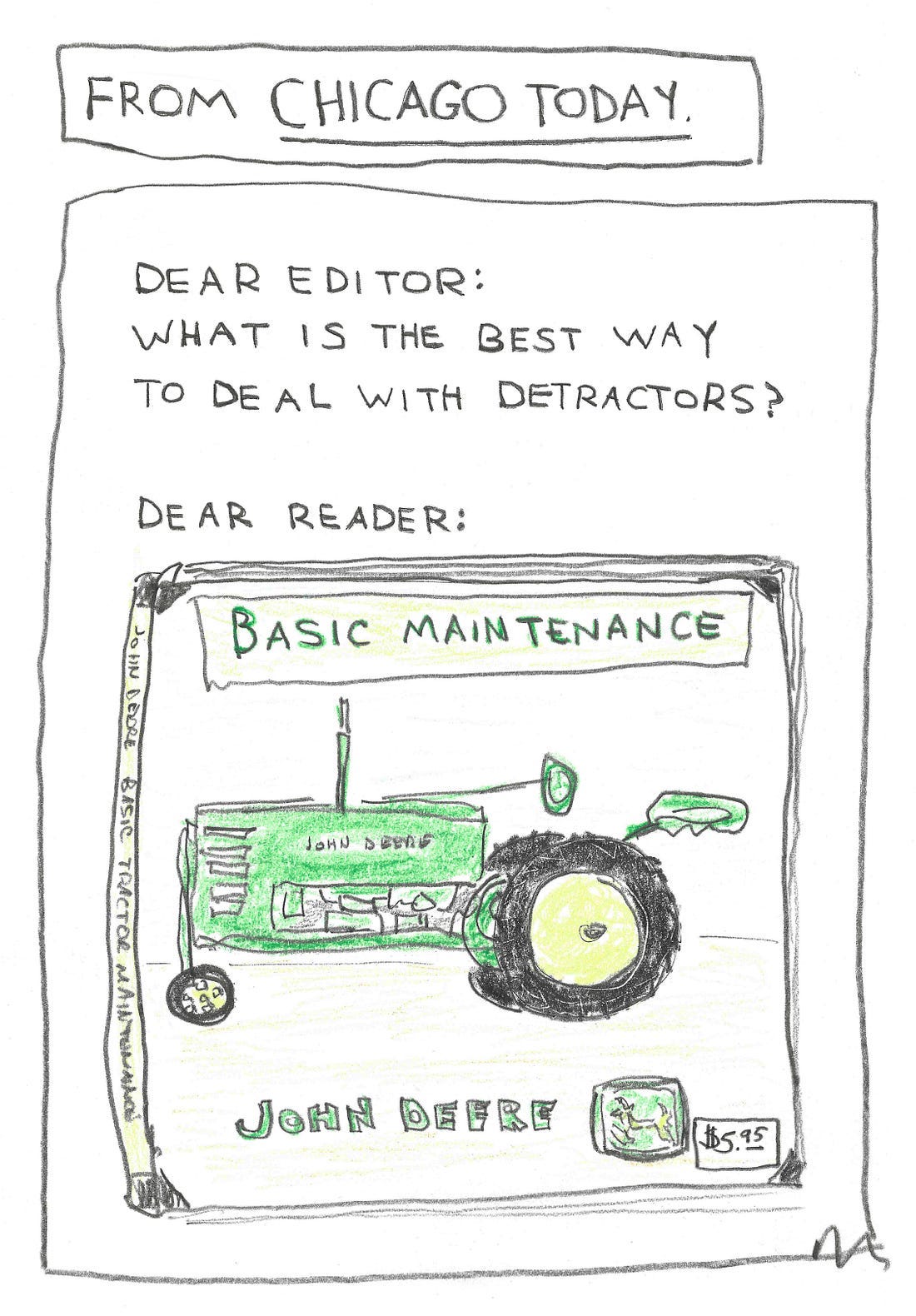

This David Mamet cartoon from The Free Press is for those of you that need to touch grass

Farmers are increasingly stressed to make ends meet and not being able to repair their own farming equipment is not helping the cause.

This pokes fun at the Right to Repair controversy, where John Deere has been widely criticized, and sued, for restricting farmers from repairing their own equipment.

What kind of exit are you likely to have?

Aura Bora, Omsom, and Tia Lupita are good examples of the lifestyle transition, the strategic roll-up, and the survival sale — type exits.

These are brands that were in or just emerging the boutique brand stage when they sold. The difference between a boutique brand vs big brand, and what lies in between will help you understand how to think about your exit.

🌱 Boutique Brands ($1–15M revenue) are founder-driven, often craft-obsessed companies with strong customer connection and challenging unit economics. These brands are facing rising costs right now and might be spending more on growth than they can comfortably afford, hoping to get to Big Brand size (many of you reading this fall into this category).

📈 Big Brands ($30M+ revenue with wide margins or $100M+ in top-line) are a different game entirely. They have a defensible moat — either unique IP, are vertically integrated or own some critical part of the supply chain, have major retail and/or DTC scale, and are either profitable or on the cusp. These are the brands that attract growth capital or strategic acquirers willing to pay out big.

🐻 Then there’s the Goldilocks Zone—brands doing $15–30M in revenue that aren’t yet big or profitable enough to attract large-scale funding but have raised too much to pivot back to boutique sustainability. This is a dangerous middle ground, and one that Aura Bora found themselves in.

Aura Bora’s exit tell-all on StartupCPG podcast YouTube

Aura Bora raised ~$22M in early funding, scaled to $12M in sales, and exited to private equity firm Next in Natural. On the outside, this might look like a success—but it was not a lucrative exit for investors.

Aura Bora was caught in the Goldilocks problem. Not big or margin-rich enough to raise the next round. Too capitalized and widely distributed to pivot to founder-led profitability. If the brand had raised less, it might have survived as a lifestyle business. If it had higher margins or greater scale, it might have raised a monster Series B. Instead, it had to sell.

As Paul Voge, Aura Bora’s founder, describes this difficulty:

"If investors put a dollar in and got a dollar and one cent out, that’s a win. But most of the time that dollar becomes 99 cents—or zero."

Tia Lupita’s Hector Saldivar tells NOSH he got strategic relief

When Hector Saldivar sold Tia Lupita to Vilore Foods, he described it as a relief, not a payday. The deal was structured as a strategic acquisition: Vilore took over operational burdens, and Saldivar remained at the helm of his brand—but as an employee, not a founder. He traded autonomy for stability and support. He now leads the brand with access to manufacturing scale and distribution leverage he couldn’t build alone.

Omsom joined a portfolio

Omsom’s acquisition by DayDayCook was a cash + stock deal over several years, with the founders staying on to lead the brand within a larger operation. No massive cash windfall. Instead, it was a lifestyle transition—relief from fundraising pressure, operational support, and continued creative control in a stable environment.

So, what’s the play?

If you're a boutique brand, your most likely exit path isn't a unicorn buyout. It's becoming a lifestyle business inside a strategic portfolio. That means:

Being radically transparent with potential acquirers

Structuring your cap table with investors aligned to your business type

Building relationships early, long before you need a sale

If you’re in-between boutique and big, choose one of two paths:

High-Growth Path

P&L shows investment in marketing, team, and velocity.

Cap table includes VC-style investors who expect long-term exits and are okay with volatility.

Sustainable Profitability Path

P&L reflects cost efficiency, gross margin optimization, and limited burn.

Investors understand slower, steadier returns—or dividend-based exits.

Most food & beverage don’t get headliner exits but those that survive get continuity and best case, a role for the founder. I’ve been here before as a founder, and lived through it with brands I advise. If you’re not sure where you’re at, contact me to sort it out.

All my best,

Jennifer

These are great insights! It'll be interesting for sure to see how the front-of-pack labelling plays out––reminds me of places like France where they have the food grade scale on each package (how healthy thinks are from A-E). Most of the foods on American shelves would probably fall in D to E thought, haha.