Making sense of almond retail prices

4-min read

If you missed last week, go back here.

Now that you understand market prices for almonds are set by handlers*, and almond sales have been waning, my response to why almond retails are still high is because of price elasticity of demand.

Almond purchases are inelastic to price.

“In an inelastic demand, when the price changes, the percentage change in quantity demanded changes less than the percentage change in price.”

This is important because it explains how retailers set profit margins and promotions (discounts). Almond snack nuts (the largest almond category) began to lose momentum going into Covid. With declining year-over-year sales, promoted volume (units sold on discount) has not made up for dollar losses.

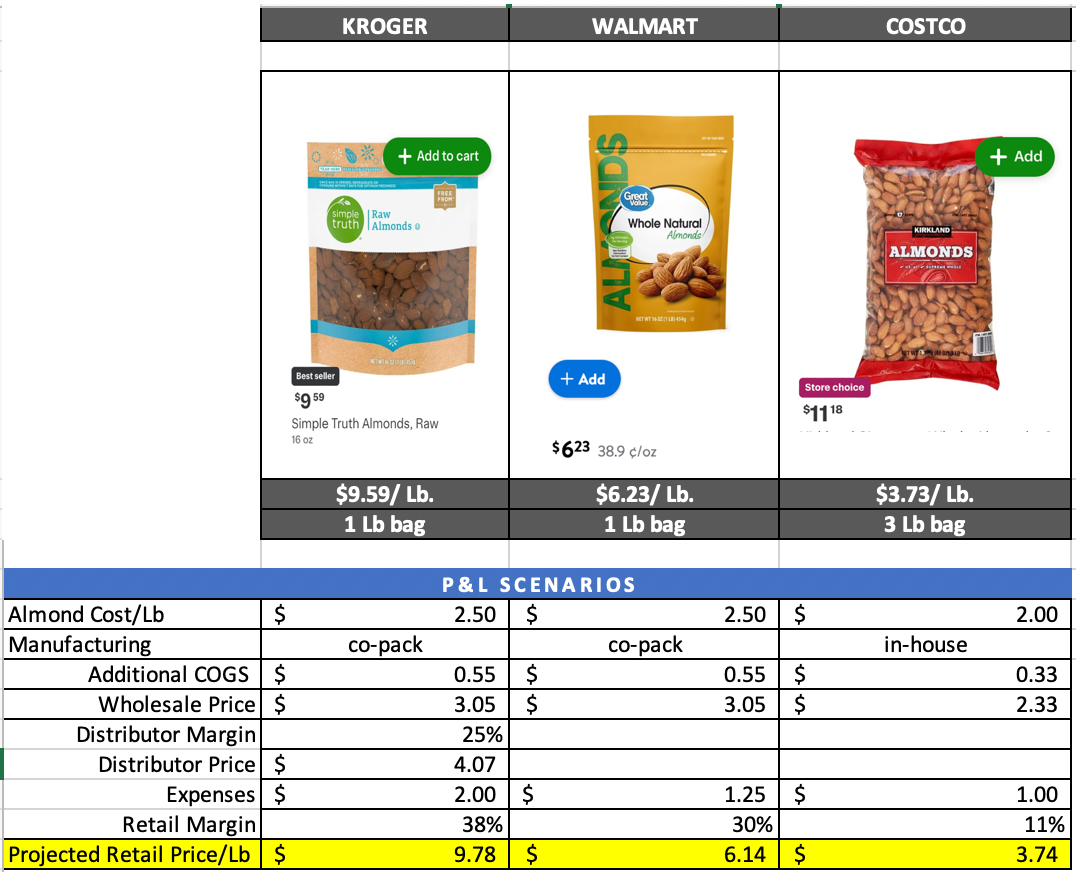

Current shelf prices

Most of the almond snack nut volume is private label (the store brand).

You are probably not surprised that Costco has the lowest price. Costco’s business model is totally different, which I’ll delve into later.

Retailer margins

Category managers are responsible for their P&Ls, meaning they have revenue goals. As explained last week, what retailers will not do, is take dollars out of their categories just to move more product. A good example of this is in the latest inflationary period, grocery categories like bakery saw units decline but dollars increase because of higher pricing and fewer discounting. A good category manager studies the effect price has on volume.

P&L Assumptions

Shelf prices are the contracted price for almonds (usually locked into annually), plus the costs of bringing these items to market, plus profit margins.

Let’s pretend Kroger and Walmart contract for almonds at $2.50/lb. Let’s also pretend they use co-packers to roast and bag. They both receive 1 lb of bagged almonds at $3.05 wholesale. But now say Kroger uses a third-party distributor to manage and move the items whereas Walmart does this internally. Additionally, Kroger, being a fancier store, promotes a few times a year and has higher expenses, whereas Walmart does not promote, because they are an Every Day Low Price (EDLP) mass discounter. Therefore, Kroger builds in a 38% margin that compresses occasionally but Walmart’s margin remains steady at 30%.

Putting all this math together you can see the resulting projected retails:

Costco is a different animal

The first thing you have to know about Costco is their profitability model is driven off of memberships not products. Costco has a strict 11 – 14% margin they take on goods just to cover their costs. You heard that right – they do not take profit margin on products – and if you want to listen to an excellent super long podcast on why Costco is this way, listen here.

Costco can buy dynamically because they do this one amazing thing:

· Sell inventory the minute it is received

They do this through a cross-dock logistics system where ready-to-sell pallets come off the truck and are immediately placed on the sales floor. Normal velocities are a pallet of almonds a week per club. With that kind of rate and efficiency, Costco buyers get real-time prices from handlers and pass that price on to the consumer. I love Costco.

And if you are wondering if Costco’s sell-through success undermines what I said earlier about price elasticity, go back and read: Costco does not profit on products, but on memberships. They attract new members and have high member retention because they offer extreme value.

All my best,

Jennifer

*technically ~30% of the market is on “call”, meaning growers trigger when to sell… but I’ll argue “marketing” almonds by calling up your broker when you are ready to sell is more trying to time the market than setting price.