How investors are looking at early stage food and beverage deals in 2025

Today:

a look at four early stage brands that got funding

group ordering is not social commerce

when California grown means something people care about

how to do a tariff related price change

Brands will be able to place ads and sponsored products on Fizz through the Instacart Ads platform, but Fizz is not social selling

Instagram’s new group ordering is not for GenX. You know when you’re splitting the bill but there’s that one person that ordered a super expensive bottle of wine no one agreed to? Fizz won’t help with that. Fizz is for when you’re having a party and invite your guests to buy the food and drinks.

There’s a different company with the same name suing Instacart which is a social platform, but on Instacart’s Fizz there’s no brand engagement.

Still, I don’t get it. I’m a GenXer and when we invite people over the food is free. If you want to bring something, that’s called being gracious and I don’t want to take that away from you.

Provenance means more when it’s directly tied to a real health benefit (or scare).

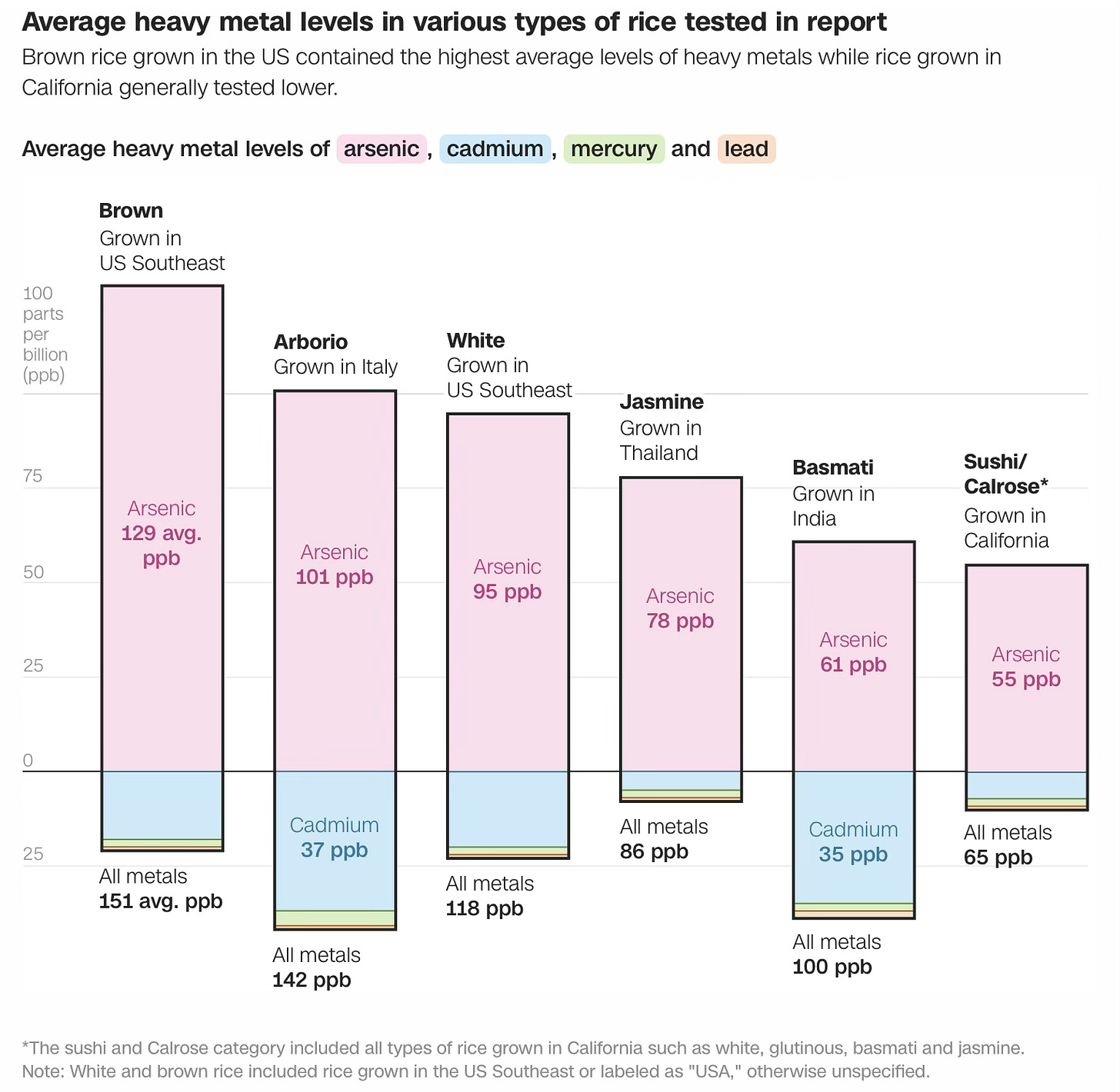

California rice has the least heavy metals in this comparison, which is a really good reason to say California on the front of your label.

Price changes due to tariffs need to follow 90 day submission

The ping pong-ing tariff games seem to be working (counting China as a win), reducing tariffs on U.S. goods to something like where they were before. Albertson’s had no clue about this, but came out early telling suppliers they won’t accept tariff related increases willy-nilly. If you are experiencing rising costs, submit your paperwork. All increases need prior authorization.

How investors are looking at deals in 2025

The economy feels worse than it is. Shoppers are being more selective, tactical, and emotionally driven in the foods they buy — and investors know it. Consumers are still splurging when the quality payoff is clear. As a result, the latest deals getting funded are brands with products that are positioned as affordable with integrity—without looking or feeling cheap. Integrity can be defined as a return to real food.

Here are some examples:

Affordable But Not Cheap

Proper Good closed a round in Q4 2024 for their shelf-stable ready meals for under $5. Clean ingredients, Walmart distribution. Affordable yet high quality and highly convenient. Designed for budget-conscious shoppers without losing product identity.

Real Food Credentials

Painterland Sisters Skyr Yogurt closed funding this year. Made by dairy farmers using local milk, no fillers, clean-label, high-protein. Mission-aligned, transparent sourcing and farm-to-fridge storytelling win both consumers and investors.

Tiered Entry Points Without Dilution

Heyday Canning is closing Series A. Launched lower-priced "Perfectly Seasoned" bean line without compromising bold flavors or brand positioning. Smart pricing tiers can expand access and loyalty.

Going Deep in Retail Where It Counts

Daily Crunch is focused on in-store distribution, offering sprouted, dehydrated nut snacks that are easier to digest, and free from added oils or sugars. Recently raised $4 million in Series A to fund expansion. Functional snacks with clean labels and strong retail execution.

You still have to have strong margins and a track record of operational know-how to get investor attention. In addition, this year early stage funding is going towards deals that are delivering affordable excellence, aligning with the return-to-real-food movement, and have a smart retail strategy.

All my best,

Jennifer