Hospitalizations are spiking and food brands are here for it

Plus, how to exit AND make money, what will replace GRAS, corporate innovation is kaput, and warm broiler chicken eggs are totally safe

First, the news:

The National Chicken Council has offered to release their (warm) eggs , which they say are totally safe, for the breaker market, alleviating the egg shortage. How nice of them.

RFK Jr. doesn’t like GRAS. Fair. GRAS (Generally Recognized as Safe) has allowed new food ingredients to enter the market without public or FDA notification. I predict the fix will come in the form of third-party reviewers (because we won’t be adding government jobs) and mandatory submissions to a searchable database. Make sense!

The LA fires brought California’s water problems to national attention. If we are going to grow more crops at home (because, tariffs) CA has really got to get its act together. Ag needs water and municipalities need water — everybody needs water. Working on this is Sarah Woolf — listen here.

BigFood backing away from brand building —> Mondelez shut down its SnackFutures brands last year and now General Mills taking down Gold Medal Ventures is a clear indication that BigFood is shifting their strategy away from corporate venture arms and will be executing M&A through their core business units. Here’s a list of in-house, corporate-venture arms operated by the world’s major packaged-food companies. I wonder which will shutter next. Innovation within the core at BigFood is still happening, for better or worse —

The DFA is messing around with milk again. Milk50 is real dairy milk with only 50 calories per serving and 75% less sugar than fat-free skim milk

It looks like Once Upon a Farm is gonna IPO

Meati closes Colorado plant after lender withdraws funds, affecting 150 workers.

Nuts + some sort of berry is making it happen for the snack nut category, which has been in decline

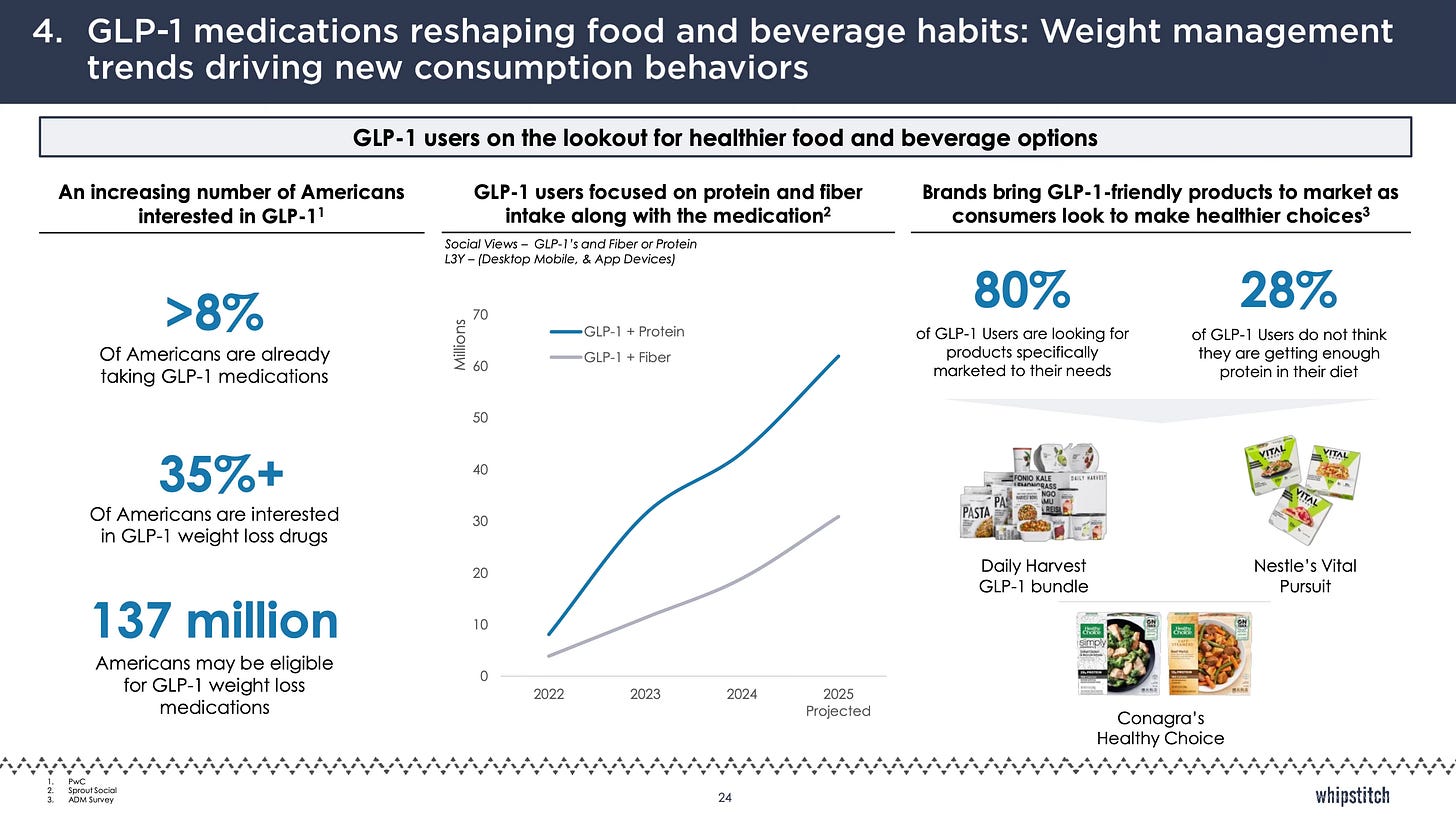

Hospitalizations due to Ozempic drug use is spiking and food brands are here for it.

Big Food has massive initiatives that every innovation has to be GLP-1 friendly, and in the absence of FDA guidance (because the FDA is busy on other fronts), brands are doing their own research.

If you don’t believe this is a big deal, here is a true story from an ED surgeon. (There is no link to this story because it was told to me firsthand)

1/3 of new patient consults in one night were for extreme stomach pain and nausea

Doctors from both surgery and gastrointestinal (GI) teams suspect these cases may be related to Ozempic

Only two of the five were obese and diabetic, meaning they had a medical reason to take the drug. The other three had relatively minor weight concerns.

CT scans showed severe inflammation in parts of the small intestine, alarming enough for emergency doctors to call in a surgeon.

While the condition didn’t require surgery, emergency doctors were hesitant to send the patients home due to the severity of their pain.

The treatment? No food or drink for 12-24 hours. Surprisingly, symptoms resolved on their own.

No one wants to end up in the ER, especially since there is a shortage of hospital beds across the country and patients ending up in hallways. Look at it another way — that these cases are showing up in the ER at all raises questions opportunities for CPG.

While the FDA has yet to publish guidance for food manufacturers, approaching GLP-1 diet companion products will look like what Supergut is doing, with scientifically supported clinical trials and research — and note they’ve just closed on a $22m Series D.

From NOSH:

As the CPG world continues to get deeper into its Ozempic Era, it's brands like Supergut that have the most to gain. Its scientifically supported take on prebiotic fiber bars, shakes and powders sets it apart from many other GLP-1 companion brands, and the team has its sights set on becoming a category leader.

Brands wanting in on this need to focus on digestibility, gut health, and satiety while minimizing ingredients that exacerbate nausea, bloating, and inflammation. Stats covered in Whipstitch Capital’s Spring Update

Aura Bora exited and no one made money

Sparkling beverage brand Aura Bora raised $22m early, and sold while doing $12m in sales. I have it from a source investors lost money.

What happened? The co was not big enough for growth capital but had raised too much to pursue founder-led profitability. This is the classic Goldilocks problem, says CPG investor and Hero CEO YC Cheng, and detailed by Inc Mag —

if Aura Bora were much smaller and hadn’t raised institutional capital, it might be able to survive as a nice lifestyle business—but its growth would be severely constrained. And if Aura Bora were much larger, with wider margins—say, a profitable business doing $30 million in sales annually, or a nonprofitable $100 million in sales—it could raise a monster Series B. Aura Bora is neither. It’s a successful national boutique brand, and that’s a tricky position to be in today.

To avoid this, you need to be very clear about your intended path and build the financial and investor structure accordingly. There are two paths:

Rapid growth, where the P&L reflects investments in marketing and expansion, and the cap table should include investors with a high-growth mindset.

Sustainable profitability, where the P&L prioritizes cost control and efficiency, and the cap table should include investors who are comfortable with a slower, more deliberate growth trajectory.

If you’re not sure which way you are headed, please contact me to sort it out.

Hero Bread is now nationwide at Whole Foods!

All my best,

Jennifer

GRAS third party verification for startup from the DOGE founders’ world. Gut govt and pass everything to private sector