Almond prices make no sense

3-min read

These are my opinions! See you in the comments.

Almonds are having a bad time. Sales are off, there are too many almonds, they’ve become super expensive to grow, and growers aren’t making any money.

If you have anything to do with almonds – buy side, sell side, or growing side – you might be wondering why prices aren’t totally slashed.

A group of growers think almond pricing should be transparent and regulated.

Another almond handler noted:

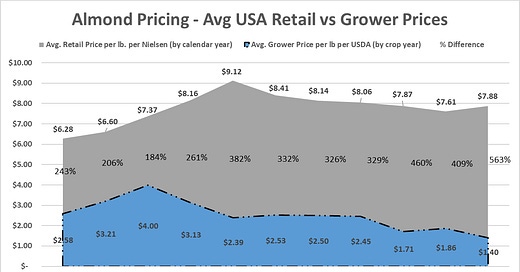

“The gap between retail pricing and grower pricing has been very disappointing.”

And posted this graph.

The inference being that retailers have been making an outsized profit on almonds at the expense of the grower in recent years.

There is a lot of speculation around how to fix almonds, which is California’s top ag export. I’m going to address what roles retailers and consumers play in the almond market.

Two truths and a lie

1. Retail pricing of almonds correlates to grower payments

2. Almond consumption goes up if you put it on sale

3. Everyone that wants to be eating almonds is already eating almonds

First truth – Almond consumption goes up if you put it on sale

People will buy more of anything they already buy if it’s on sale. It’s called pantry loading. Pantry loading does nothing for the retailer if the dollars are not accretive to the category overall. . By discounting the price, more units will move but at less overall dollars. Retailers do not want to take dollars out of their categories just to move more product.

Almond snack nuts (the largest almond category) began to lose momentum going into Covid. With declining year-over-year sales, promoted volume (units sold on discount) has not made up for dollar losses.

Second truth – Everyone that wants to be eating almonds is already eating almonds

This is hard for me to say, but I think we’ve reached peak almond. There is still a lot of innovation going on, but no new breakthroughs like almond butter and almond milk.

Blue Diamond Growers just announced their new channel strategies, such as foodservice – think barista blend almond milk – and going international with their brands, which include Almond Breeze. Sales for Blue Diamond were down 17% in fiscal year ending in August.

And a lie – Retail pricing of almonds correlates to grower payments

Growers don’t set price, handlers do*. What’s missing from the graph above are market prices. Over the last decade, market prices have swung from over $4.00 per lb to under $2.00 per lb.

· Market prices for almonds are opaque, by design

· Market prices often reflect speculation, not the current supply/demand situation

· Not publicly traded on any US exchange; there is no governing body that regulates almond prices

Contracting (locking in price) for almonds vs buying on spot can be a guessing game. I often get asked about pricing outlook, and I’ve learned it can be more about sentiment than data.

Which brings me to the retailer business model

I did a store check on almond prices this week and you won’t be surprised to know that Costco had the lowest price. Waaay lower than Kroger and Walmart. Costco’s business model is totally different, which I’m not going to get into today.

What goes into these prices are the contracted price for almonds (usually locked into annually), and the costs of bringing these items to market – which have been rising. How retailers build in margin has to do with category and brand power, and goals to lap previous year sales.

Next week I’ll be digging into the retailer P&L, Costco’s model, and how costs and profit margins ladder up to get to these retails.

All my best,

Jennifer

*technically ~30% of the market is on “call”, meaning growers trigger when to sell… but I’ll argue “marketing” almonds by calling up your broker when you are ready to sell is more trying to time the market than setting price.